Has The Flame Dimmed For Cannabis Retail In Traverse City?

By Craig Manning | Sept. 28, 2024

It’s been a year and a half since the City of Traverse City awarded 16 recreational marijuana licenses after a protracted process. Eighteen months later, Traverse City’s number of pot shops is already dwindling, with two dispensaries shuttered, two that never opened, and two more for sale. How many stores will be left when the dust settles?

According to City Clerk Benjamin Marentette, whose office administers the city’s retail marijuana licenses, there are currently 12 active licenses in the City of Traverse City. Those belong to Verts on South Union Street; Lume on West Front Street; Green Pharm on Parsons; Stash House on Division; Gage on Hannah Avenue; Puff and Lighthouse, both on Garfield; Dunegrass and Olswell, both on East Front Street; and Cloud, Highly Cannaco, and House of Dank, all on Munson Avenue. Marentette specifies that “active licenses,” in this context, means “the entities have their doors open and are operating.”

One other license from Traverse City’s initial 16 is technically still on the table, and could be activated in the future if the owner wishes to do so. 314 Munson Avenue, a property granted a license all the way back in Traverse City’s initial medical marijuana lottery draw, never opened its doors and “hasn’t applied for their state license yet,” according to Marentette. Despite the dormancy of that space, owners did go through last year’s recreational marijuana application process to upgrade the license. However, the 426-square-foot property is for sale for $725,000, and listing agent Blake Bernard of Real Estate One says the listing “is for real estate only” and doesn’t include the license. Per Marentette, if the building does change hands, “the license would cease to exist.”

Similarly, three of Traverse City's other recreational licenses are dead and can’t be renewed. One was granted to Traverse City Cannabis Company, which planned to operate an adult-use dispensary at 934 Hastings Street. That business never opened, and Marentette tells The Ticker the applicant let the license lapse when it came up for renewal.

Two other pot shops have closed their doors, both of them part of Traverse City’s original class of medical-only dispensaries. The first, the Skymint store on East Front Street, was part of a large statewide brand that has faced significant financial challenges. The second was the Nirvana Center, the dispensary previously located next to Rare Bird Brewpub on Lake Avenue.

Unlike liquor licenses, which can be bought or transferred after a restaurant or bar closes, Marentette says the Skymint and Nirvana Center licenses are now gone forever.

“If a dispensary closes, then the license disappears and is not up for grabs,” Marentette says. He clarifies that dispensaries can indeed be sold along with their licenses. But, “in order for a business to sell their license, they need to be operational until the license is sold.”

Such appears to be the plan for at least two of Traverse City’s dispensaries: Olswell and Gage are listed for sale – the former for $1.2 million, the latter for $2.55 million – with licenses included. Both stores continue to operate as they seek buyers.

Sales, closures, and other market shakeups aren’t unexpected developments for Traverse City’s marijuana landscape. Speaking to The Ticker last October, leaders from Puff, Lume, and Cloud all predicted that a quarter or more of the city’s dispensaries would eventually close.

Nick and Eric Piedmonte, the local brothers who own and operate Dunegrass and its eight northern Michigan dispensaries, expect market headwinds will continue to drive attrition in Traverse City for several years.

“I continue to think they overshot it,” Nick says of the city’s decision to allow up to 24 adult-use licenses within Traverse City’s 8.6-square-mile footprint. “Six was the right number.”

Of Traverse City’s 12 remaining dispensaries, Dunegrass is unique in that it is owned and operated by Traverse City residents. Most local shops are part of larger brands based downstate. Early on, that lack of a larger backing was an anchor: The Piedmontes have gone on record about how lacking the deep pockets of some of their competitors left them on the outside looking in when medical marijuana first came to Traverse City in 2019. Now, though, the brothers say being smaller and nimbler gives them an advantage.

“We didn't have a big appetite for getting into growing or processing, and in the initial stages, that looked like a mistake,” Nick says. “Six years on, though, we continue to feel like that was the right decision.”

Eric explains that many statewide cannabis brands are “vertically integrated,” which means they plant, grow, process, and sell their own product. The problem, he says, is that many of those companies overextended themselves, either in building out expensive grow operations or opening dozens of locations across the state. Skymint, which had 24 stores in Michigan before being placed in receivership due to $127 million worth of debt, is an example. As Michigan marijuana prices crater due to a massive surplus of product – according to Crain's Detroit, pricing has plummeted 14.5 percent to record lows in 2024 – Eric says not having a grow operation is actually a benefit for Michigan weed retailers.

“We’re not forced to put something on our store shelves simply because we produce it,” Eric explains. “Instead, we’ve established partnerships with other suppliers, and have geographic exclusivity with what we consider to be three of the five best flower growers in the state of Michigan. That gives us a really high-end product that you can’t find at other local retail, which helps insulate us from price compression. And then, on top of that, we’re able to have good inventory control. A lot of dispensaries hold a lot of inventory, and then find themselves with stale product. Our structure allows us to have fresh, recently-cultivated product on our shelves at all times.”

Even if the Piedmontes think six was the sweet spot for recreational marijuana licenses in TC, the city technically allows 24 adult-use dispensaries. Could new licenses be issued as the local market thins out?

“The ordinance provides that the application window may be reopened by the city clerk,” Marentette says. “At this time, we have not explored, nor been approached, about seriously considering opening up a window for new applications for the retail licenses.”

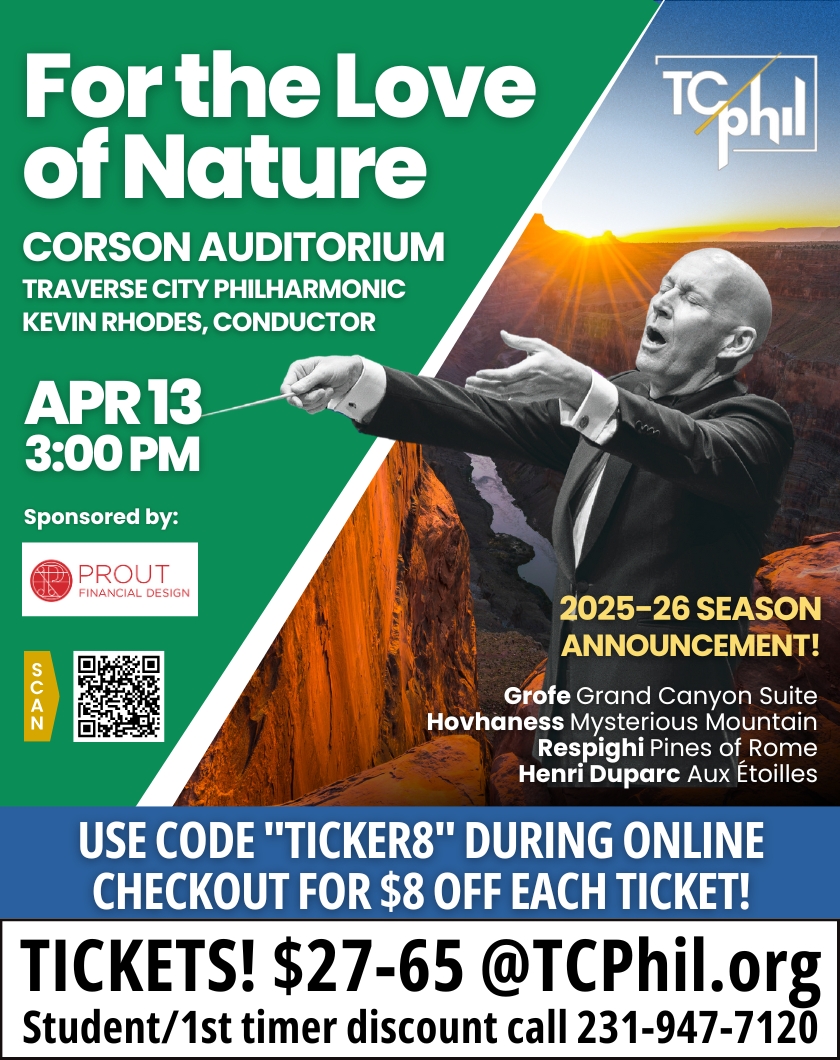

Photo courtesy of Dunegrass.

Comment